Using a credit card to make a purchase is a simple and common payment option. The typical procedures for using a credit card are as follows:

- You must apply for a credit card from a bank or other financial organization if you don’t already have one. Complete the application form and attach any essential paperwork and information.

- Activate Your Card: Your credit card might need to be activated when you get it in the mail. To activate it, according to the directions given by the company that issued your credit card. Calling a toll-free number or using the issuer’s website to activate it online are the usual options.

- Become familiar with the Card: Read your credit card’s terms and conditions, interest rates, fees, and any incentives or bonuses offered. You can make wise selections and use your credit card responsibly if you are aware of these facts.

- Purchases: Simply offer your credit card to the seller at the point of sale to make purchases. Depending on the transaction type, you could be required to physically hand over your credit card or only give the card information over the phone or online.

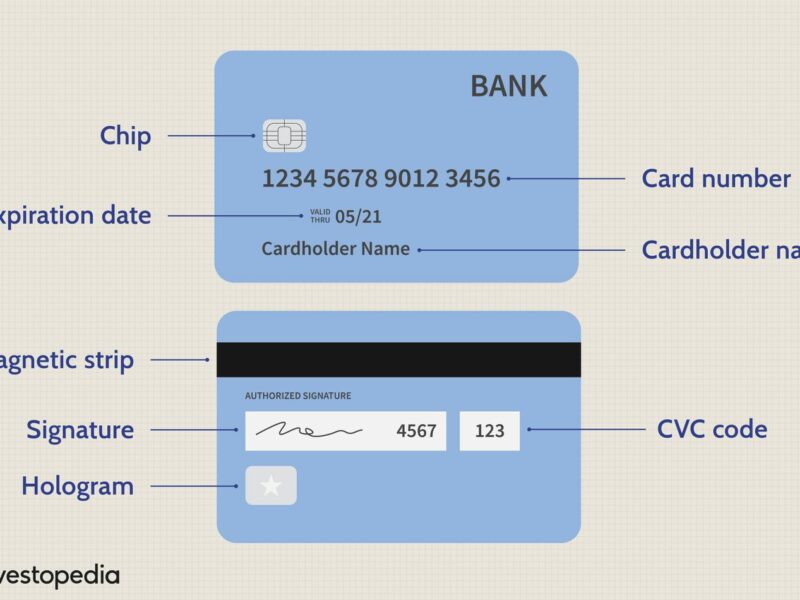

- Your credit card will normally be swiped through the card reader at the payment terminal if it has a magnetic stripe. If your card has a chip, place it in the reader and adhere to the instructions displayed on the screen. For enhanced protection, you might occasionally be prompted for your PIN (Personal Identification Number).

- After your credit card has been processed, you might be asked to sign a receipt to verify the transaction. If the purchase amount is accurate, check it, then sign the receipt. When utilizing contactless payment methods or for short purchases, certain shops could no longer demand signatures.

- Keep note of Your Spending: To keep tabs on your spending and assure accuracy, it’s crucial to keep note of all credit card transactions. Review and reconcile your monthly credit card statement with your receipts, either online or by mail. Report any anomalies or unauthorized charges right away to the company that issued your credit card.

- Make Payments: Credit cards let you buy things on credit, but to avoid interest and late penalties, you must make your payments on time. By the deadline, make a minimum payment of the amount shown on your credit card statement. When at all feasible, pay the entire sum to avoid accruing interest.

- Pay Attention to Credit Limits: Your credit card will have a predetermined credit limit that determines the most you are permitted to spend with the card. To maintain a good credit utilization ratio, which can enhance your credit score, try to keep it far below your credit limit.

- Keep your credit card information safe and secure by protecting it. If you don’t have confidence in the source, don’t tell anyone. Make sure you are on secure websites while transacting online by looking for “https” in the URL, and be wary of potential scammers.

- Keep in mind that appropriate credit card use entails utilizing credit sensibly, paying your bills on time, and maintaining a low total credit utilization. Utilizing a credit card may help you establish credit, receive rewards, and offer extra protection for your purchases.

Also Read: How to Use Amazon Pay Balance

Conclusion

In conclusion, using a credit card to make transactions may be easy and safe. You may profit from using a credit card while successfully managing your money if you follow the above instructions and use your card wisely. Keep in mind to keep up with the terms and conditions of your credit card, keep an eye on your spending, pay your bills on time, and protect your card information. You may maximize the use of your credit card while preserving a sound financial situation by doing this.

FAQ

Q. How can I pick a credit card that’s best for me?

A. Think over things like your spending patterns, credit score, interest rates, fees, rewards programs, and any other perks that may be available. Choose a credit card that fits your requirements and financial objectives by comparing the many available possibilities.

Q. A credit limit is what?

A. The maximum sum of money you may borrow with a credit card is known as a credit limit. Based on elements including your credit history, income, and trustworthiness, the credit card issuer has predicted what it will be.

Q. A minimum payment is what?

A. The smallest monthly payment you must make to maintain the health of your credit card account is known as the minimum payment. Typically, it represents a little portion of your outstanding debt. However, making merely the required minimum payment may cause interest costs to mount.

Q. How can I prevent paying interest?

A. Pay down the entire sum on your credit card before the due date specified on your statement to avoid interest fees. You won’t be assessed interest on your purchases if you do this. When you carry an amount over from one billing cycle to the next, interest is often assessed.

Q. What safeguards can I take against credit card fraud?

A. By keeping your card safe and never giving it to anybody else without their permission, you can protect your credit card information. When buying something online, exercise caution and make sure the website is safe. Keep an eye on your credit card transactions regularly, and report any unusual behavior right away to your credit card company.

Q. What must I do if my credit card is stolen or lost?

A. If your credit card has been lost or stolen, notify it as quickly as you can to the company that issued it. They will advise you on how to safeguard your account, including how to deactivate the card and get a new one.

Q. How can I use my credit card to get a solid credit history?

A. Keep your credit utilization ratio (the amount of credit you use relative to your credit limit) low by making on-time payments and using your credit card wisely. This displays prudent credit use and can support establishing a solid credit history.

Q. Can I get a cash advance using my credit card?

A. Yes, you can get cash advances from ATMs or by asking the credit card company for cash with the majority of credit cards. Be careful, too, that cash advances sometimes have higher interest rates and sometimes even extra costs.